04 | The heart of Hafnia

Hafnia’s pools

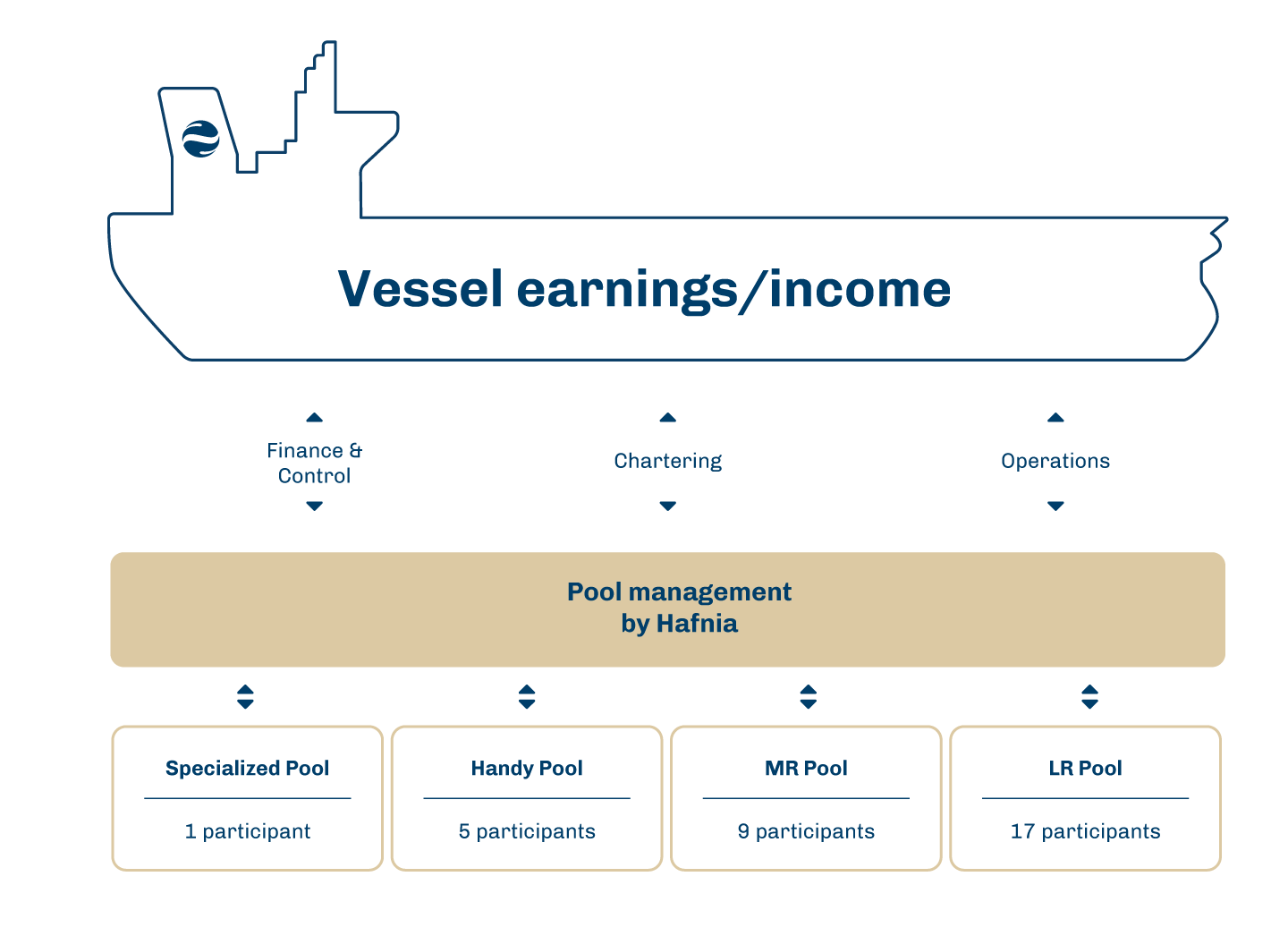

As per 31 December 2020, Hafnia operated a fleet of 184 vessels including newbuild and vessels chartered out on long-term charter contracts in our four pools which range from small specialised chemical tankers to the largest product tankers. The pools are managed to maximise both fleet utilisation and revenue within a cyclical freight market.

Hafnia’s highly specialised and dedicated chartering and commercial departments are responsible for developing, marketing, and negotiating all contracts for both the product tanker vessels and the chemical tankers that the pools operate.

Hafnia’s chartering department primarily trades the vessels in the spot market. All contracts in the pools are negotiated and secured by the pools under instruction and authority from the Pool Board.

Each pool is managed by a pool board comprising representatives from each pool member. The pool board is the pool’s governing body, overlooking the pools’ overall strategic management.

Functioning, structure and size

When employed in a pool, a vessel is part of a fleet of similar vessels, brought together by their owners to exploit efficiencies, economies of scale and benefit from a revenue/loss-sharing mechanism. The pool operator sources different cargo shipment contracts and efficiently directs and operates the vessels to provide the services needed pursuant to such agreements.

The Specialized Pool comprises 17 chemical vessels and has 1 pool participant. The Handy Pool comprises 23 Handy vessels and has 5 pool participants. The MR Pool comprises 62 MR vessels and has 9 pool participants. The LR Pool comprises 82 LR vessels and has 17 pool participants.

Pool earnings

The earnings allocated to vessels are aggregated and divided based on a pool point system, reflecting comparative voyage results on hypothetical benchmark routes. The pool points system is weighted by attributes such as size, fuel consumption, classification and other capabilities. Pool revenues are only recognised for the given period during which the vessel has participated in a pool, and when the amount of pool revenue during that period can be estimated reliably.

Hafnia receives pool management commission in the form of a fixed fee and a percentage of all net pool income from voyage charters, time charters and other charters.

Operations

Hafnia’s operations department is responsible for managing the performance of the vessels during their voyages. This includes each vessel’s compliance with the terms and conditions of the applicable charter party contracts and the active management of voyage costs to optimise each vessel’s earnings.

Bunkers

Hafnia’s Bunker department is responsible for the competitive procurement of bunker for both pools and third parts customers.

Hafnia receives commission in the form of a fixed fee per ton of all bunker purchased.

Strategy 2021

In 2020, Hafnia expanded the pool management business with the specialized chemical tanker segment, and Hafnia seeks to further expand its commercial management business into new segments in the years to come. In addition, Hafnia’s strategy is to increase the number of vessels in its four pools through adding external vessels with the right pool partners, while maintaining its customised approach to pool management.