08 | Governance

Corporate governance

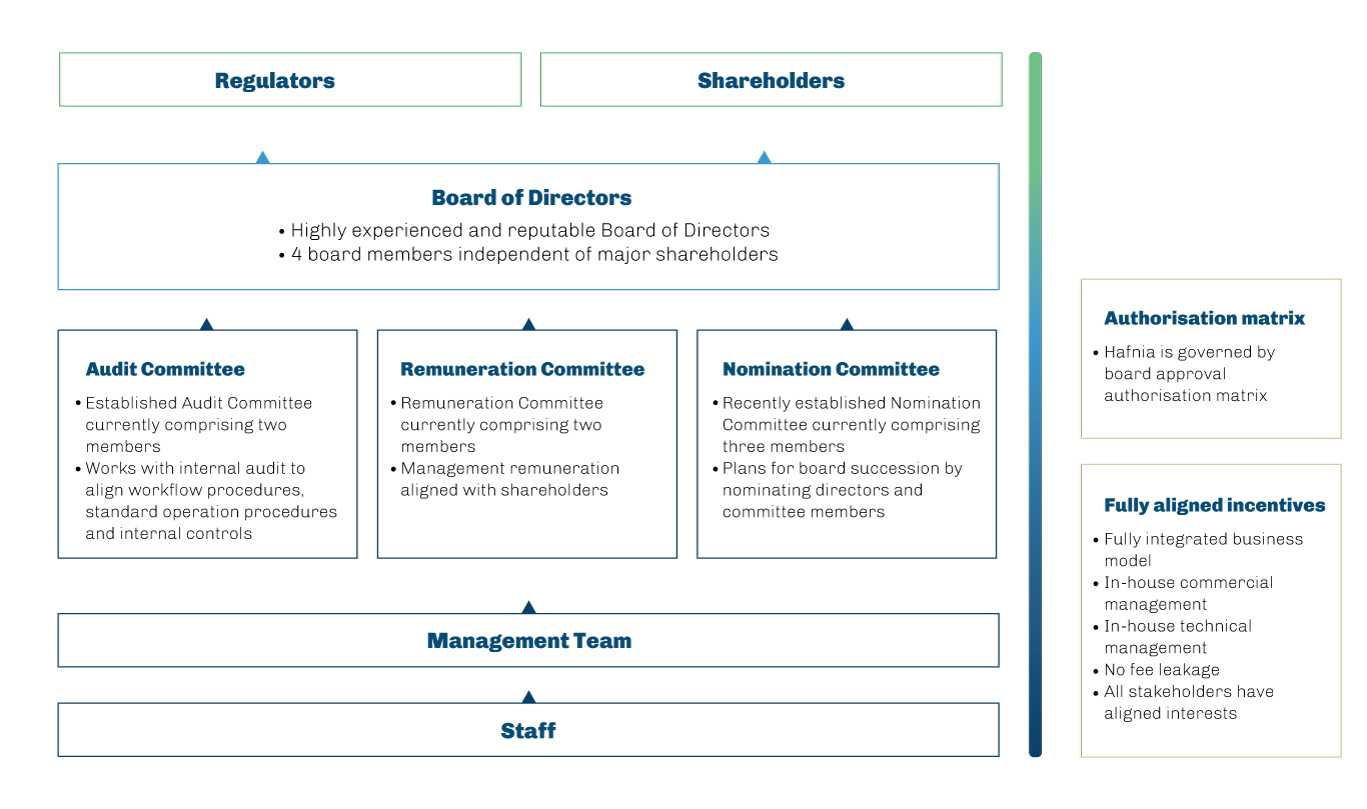

Hafnia is fully focused and committed to upholding the highest corporate governance standards, professionalism and business integrity across all activities. To achieve that, the development, implementation and maintenance of well-functioning governance policies and practices are critical.

Hafnia’s governance policies and practices are created to comply with applicable laws and ethical standards while being mindful to the Company’s long-term performance and financial soundness.

The policies abide to the overall principles of uprightness and fairness in accordance with leading market practices, while aligning with the interests of the Board and management, and balancing the reasonable expectations of shareholders, employees, customers, suppliers, other contracting parties and the public.

Board and Management presentation

Hafnia’s management team consists of seasoned executives who have extensive experience and vast networks of strong relationships with major oil and gas companies, shipyards, global financial institutions and other key shipping industry participants. They have demonstrated their ability to manage the commercial, technical and financial aspects of Hafnia’s business, backed by years of senior-level experience operating large and diverse fleets of energy transportation vessels, as well as other assets within the maritime sector.

A Board of Directors complements Hafnia’s management with extensive collective international experience in shipping, energy and capital markets – as well as a broad range of complementary functional competencies. This allows a good balance of knowledge, expertise and diversity appropriate to promote different perspectives and mitigate against groupthink.

The Board of Directors is responsible for the overall management of the Company and may exercise all of the powers of the Company not reserved to the Company’s shareholders by its bye-laws or under Bermuda law.

The Board

Andreas Sohmen-Pao

Chairman

| Position: | Chairman |

|---|

Andreas Sohmen-Pao is Chairman of BW Group and listed affiliates BW LPG, Hafnia, BW Epic Kosan, BW Offshore and BW Energy. He is also Chairman of the Singapore Maritime Foundation. He has previously served as a non-executive director of The Hongkong and Shanghai Banking Corporation, the Maritime and Port Authority of Singapore, The London P&I Club, and Sport Singapore amongst others. Prior to joining BW, Mr. Sohmen-Pao worked at Goldman Sachs International in London. He is a graduate of Oxford University and Harvard Business School. He resides in Singapore.

Erik Bartnes

Director

| Position: | Director |

|---|

Erik Bartnes was co-founder of Pareto AS and senior partner from 1988 to 2010, and Chairman of Pareto AS until April 2013. Mr. Bartnes is one of the co-founders of the original Hafnia Tankers in 2010 and served as Executive Chairman until 2018. Currently, Mr. Bartnes serves as Chairman in Eclipse Drilling AS, Revier Invest AS , Svele AS and Johan Vinje AS. Mr. Bartnes is a board member of Pareto Asset management, Pareto Invest, Premium Maritime Fund AS, Thor Dahl Shipping AS and Ulstein Group AS. Previously, Mr. Bartnes served as a board member or Chairman of Christiania Shipping A/S, Eitzen Chemical ASA, Viking Cruises Ltd, Nordic Tankers, Nordic Shipholding, Siva Shipping AS and Ugland Shipping AS. Mr Bartnes holds a LizRerPol degree from University of Fribourg in Switzerland. Mr. Bartnes resides in Oslo.

Donald John Ridgway

Director

| Position: | Director |

|---|

Donald John Ridgway was CEO of BP Shipping from 2008 to 2015. Mr. Ridgway is a qualified Master Mariner, and has a master degree from the Judge Institute, Cambridge University. He is a Chartered Marine Technologist and a Fellow of the Institute of Marine Engineering, Science and Technology, and is currently Chairman of Tindall Riley Ltd, a leading marine liability insurer. He was formerly Chairman of the Oil Companies International Marine Forum and the Marine Preservation Association LLC, President of the API Marine Committee, Director of a number of businesses and organisations including Britannia P&I Insurance Ltd., Alaska Tanker Company, ITOPF, and UK Chamber of Shipping and a member of the Executive Advisory Board to the UN IMO World Maritime University. Mr. Ridgway resides in London.

Ouma Sananikone

Director

| Position: | Director |

|---|

Ouma Sananikone is currently a non-executive director of Innergex (Canada), Ivanhoe Cambridge (Canada), and Macquarie Infrastructure Corporation (U.S.). Ms. Sananikone was also chairman of, among others, Smarte Carte (U.S.) and of EvolutionMedia (Australia) and recently retired from a non-executive directorship of the Caisse de Depot et Placement de Quebec (Canada). She also acted as an honorary Australian Financial Services fellow for the U.S. on behalf of the Australian government. Additionally, Ms. Sananikone has held various other senior positions, including CEO of Aberdeen Asset Management (Australia), CEO of the EquitiLink Group (Australia, New Zealand, USA, Canada and UK) as well as founding managing director of BNP Investment Management (Australia). Ms. Sananikone has always been committed to the community, serving as a board director of a number of arts, education and charitable organisations, among them the United Nations High Commission for Refugees. Ms. Sananikone holds a BA (Economics and Political Sciences) from the Australian National University and a Master of Commerce (Economics) from the University of New South Wales. She is a recipient of the Centenary Medal from the Australian Government for services to the Australian finance industry. Ms. Sananikone resides in New York.

Peter Graham Read

Director

| Position: | Director |

|---|

Peter Read is currently the Non-Executive Chairman of Welbeck Publishing Group Limited. He is also a Non-executive Director and Chairman of the Audit Committees of QMM Holdings Limited and the Professional Cricketers Association. Mr. Read is also a Member of the Board and Chairman of the Audit and Motoring Committees of the Royal Automobile Club. In a career spanning 37 years at KPMG, Mr. Read was a partner and sector chairman. Mr. Read graduated from Southampton University with a degree in Commerce and Accountancy. He is also a Fellow of the Institute of Chartered Accountants in England and Wales. Mr. Read resides in London and Sussex, England.

| Andreas Sohmen-Pao | Erik Bartnes | Donald John Ridgway | Ouma Sananikone | Peter Graham Read | |

| Attendance 2020 | 4/4 | 4/4 | 4/4 | 4/4 | 4/4 |

| Gender | Male | Male | Male | Female | Male |

| Residency | Resides in Singapore | Resides in Oslo | Resides in England | Resides in New York | Resides in London |

| Independent | No | Yes | Yes | Yes | Yes |

The Management

Mikael Øpstun Skov

Chief Executive Officer

| Position: | Chief Executive Officer |

|---|

Mikael Øpstun Skov is Chief Executive Officer of Hafnia, a role he assumed in 2019 after the merger between Hafnia Tankers and BW Tankers. Mr. Skov was the co-founder and CEO of Hafnia Tankers and has more than 35 years in the shipping industry. Prior to establishing Hafnia Tankers, Mr. Skov held various positions over his 25-year career at Torm A/S, of which the last two years he served as CEO. Mr. Skov is a Board Member of BLS Invest and Clipper Group Ltd. Mr. Skov resides in Monaco.

Perry Wouter Van

Chief Financial Officer

| Position: | Chief Financial Officer |

|---|

Perry Wouter Van Echtelt is Chief Financial Officer of Hafnia, a role he assumed in November 2017. Mr. Van Echtelt has more than 20 years of experience in investment banking and ship finance. Prior to Hafnia, Mr. Van Echtelt was at ABN AMRO Bank as head of transportation and logistics Asia Pacific & Middle East. For 17 years, Mr. Van Echtelt held various positions in the corporate finance and capital markets group of ABN AMRO and its predecessors (MeesPierson and Fortis Bank), and at Gilde Investments from 1998 until 2000. Mr. Van Echtelt resides in Singapore since 2013.

Audit Committee

In line with the recommendations set out in the Corporate Governance Code, Hafnia has established an Audit Committee comprising two Members; Peter Graham Read (Chairman) and Erik Bartnes (Committee Member). Neither of them were previous partners or directors of the Company’s external auditor, KPMG, within the last 12 months or hold any financial interest in KPMG.

The Members of the Audit Committee are independent of the Company. The Board considers Peter Graham Read, who has extensive accounting and auditing experience, well qualified to chair the Audit Committee. Together, the Audit Committee collectively have strong accounting and related financial management expertise. They will keep informed of relevant changes to accounting standards and matters that may directly impact the financial statements. The Members of the Audit Committee will serve while they remain members of the Board of Directors, or until the Board of Directors decide otherwise or wish to retire from their appointment as Members of the Audit Committee.

The Audit Committee’s primary purpose is to act as a preparatory and advisory committee for the Board of Directors in discharging responsibilities relating to the integrity of financial statements, monitoring the Group’s system of internal control of risk management and independence of the external auditor.

This includes but is not limited to:

- All critical accounting policies and practices

- Quality, integrity and control of the Group’s financial statements and reports

- Compliance with legal and regulatory requirements

- Qualifications and independence of the external auditors

- Performance of the internal audit function and external auditors

The Audit Committee reports and makes recommendations to the Board of Directors, but the Board of Directors retains responsibility for implementing such recommendations.

Internal audit

The internal audit department prepares and implements a robust audit plan, to assess the adequacy and effectiveness of Hafnia’s governance, risk management and internal controls. This includes the operational, financial, compliance and information technology controls. Without assuming management responsibility, internal audit also provides independent, objective assurance and consulting services designed to add value and improve Hafnia’s operations and ensure that the control environment works effectively.

This helps Hafnia accomplish its stated objectives and goals by bringing a systematic, disciplined approach to add value and improve governance, risk management and internal controls. The Audit Committee is responsible for approving the terms of reference of internal audit and reviews the internal audit function’s adequacy and effectiveness. The Audit Committee also ensures that processes are in place for recommendations raised in internal audit reports and dealt within a timely manner.

The internal audit department is staffed with individuals with the relevant qualifications and experience. However, where appropriate, independent internal or external technical specialists will be engaged to supplement the core team, and quality assurance and improvement practices. Internal auditors are expected to apply the care and skill expected of a prudent and competent auditor and consider using technology-based audit and other data analysis techniques in their work.

Authorisation manual

Hafnia has established a clear and concise authorisation manual that sets out, describes and defines roles and responsibilities in all aspects of the Company’s business financials, including:

- Governance & Senior Appointments

- Budgeting & Expenditure

- Financing & Financial Risk Management

- Public Relations, Media & Communication

- Legal & Liability Management

- HR

- Chartering

- Sales & Purchase Of Vessels

- Bunkers & Agents

- Fleet

- Insurance

- IT

- The Pools

Remuneration Committee

Hafnia’s Remuneration Committee comprises of two Members; Andreas Sohmen-Pao (Chair-man) and Erik Bartnes (Committee Member). The Board considers that Andreas Sohmen-Pao, who has many years of experience in senior management positions and on various Boards is well qualified to chair the Remuneration Committee. Together, the Remuneration Committee collectively have strong management experience and expertise on remuneration issues.

The Members of the Remuneration Committee shall serve while they remain part of the Board of Directors, or until the Board of Directors decide otherwise or wish to retire from their appointment as Members of the Remuneration Committee. Any remuneration to be paid to the Remuneration Committee members is to be decided at the annual general meeting.

The Remuneration Committee’s primary purpose is to assist the Board of Directors in discharging its duty relating to determining the management’s compensation.

This includes but is not limited to:

- Oversee the governance of Hafnia’s remuneration policy

- Oversee the remuneration of the Board and Management

- Reviews Management annual increments, variable bonuses and incentive awards

- Approves framework of remuneration for the entire organisation, including increment and incentives

The Remuneration Committee shall report and make recommendations to the Board of Directors, but the Board of Directors retains responsibility for implementing such recommendations.

Nomination Committee

As provided for in its by-laws, Hafnia has established a Nomination Committee in the 2020 annual general meeting of the Company. The Nomination Committee comprises of three Members; Andreas Sohmen-Pao (Chairman), Bjarte Bøe (Committee Member) and Elaine Yew Wen Suen (Committee Member). The Members of the Nomination Committee shall serve until the Annual General Meeting (AGM) determines or they wish to retire from their appointment as they of the Nomination Committee.

The Nomination Committee’s primary purpose is to identify and nominate candidates for the appointment, re-appointment or termination of Members and Chairman of the Board of Directors, and make recommendations for these persons’ remuneration. The Nomination Committee plays an essential role in emphasising transparency and meritocracy at Hafnia. It plans for board succession while ensuring only candidates with the suitable attributes and expertise capable of contributing to the Company’s success are appointed.